Chandigarh Group of Colleges Mohali(Jhanjeri) secures prestigious NIRF rankings across PAN India.

Chandigarh Group of Colleges Mohali(Jhanjeri) secures prestigious NIRF rankings across PAN India.

Chandigarh Group of Colleges Mohali secures prestigious NIRF rankings across PAN India.

Chandigarh Group of Colleges Mohali secures prestigious NIRF rankings across PAN India.

Education Loan

CGC Mohali (Jhanjeri) offers education loans to help students pursue their academic goals without financial constraints. These loans are designed to cover tuition fees, books, accommodation, and other related expenses. With flexible repayment options and competitive interest rates, CGC Mohali (Jhanjeri) ensures that students can focus on their studies without worrying about financial burdens.

Additionally, the institution provides guidance and support throughout the loan application process, making it accessible and hassle-free for students aspiring to further their education.

Pay Fees In Easy EMI With Gray QuestPay Fees In Easy EMI With Gray Quest

Pay your College fees in easy monthly installments with GrayQuest. India's Largest Education Fee Financial Portal.

www.grayquest.comApply for Education Loan

Most banks, either State or Central Government, are providing attractive student loan facilities to encourage students to pursue higher education despite their financial shortcomings. Therefore, CGC Mohali (Jhanjeri) has set up a dedicated loan assistance cell, the one-stop solution for students to obtain loans from banks with which the college has tie-ups.

Through Vidya Lakshmi Portal

Starting on 1 February 2018, the central government made it mandatory for banks to offer education loans only through the Vidyalakshmi portal. Vidya Lakshmi is an education Loan Portal managed by NSDL e-Governance Infrastructure Limited, Mumbai.

Vidya Lakshmi Portal serves as an online platform enabling students to conveniently explore, compare, and apply for educational loans and scholarships at their convenience, from anywhere and at any time. Not only does the portal facilitate the exploration of student loans, but it also allows students to directly apply for education loans and monitor the application process.

Students must register and log in at https://www.vidyalakshmi.co.in/Students/ and fill up the Common Education Loan Application Form (CELAF) by providing all the necessary details. After filling out the form, the applicant can search for Educational Loan and apply as per his/her needs, eligibility and convenience.

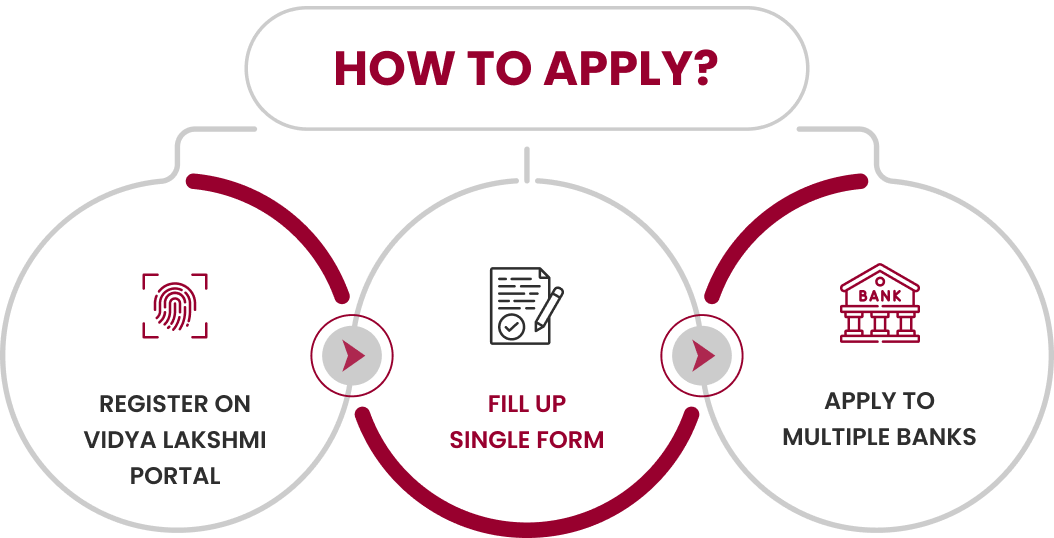

HOW TO APPLY?

REGISTER ON VIDYA LAKSHMI PORTAL

REGISTER ON VIDYA LAKSHMI PORTAL

FILL UP SINGLE FORM

FILL UP SINGLE FORM

APPLY TO MULTIPLE BANKS

APPLY TO MULTIPLE BANKS

Through Direct Approach In Bank

It is recommended to visit the bank branch where one of the parents holds an account. However, it is the responsibility of the students and their parents/guardians to secure approvals and manage the repayment of the approved loan, along with any associated liabilities and consequences. CGC Mohali (Jhanjeri) will not be held liable or responsible in this matter.

EDUCATION LOAN PARTNERS

Enroll with Ease: Credit Card SchemeS

Bihar Student

CREDIT CARD SCHEME

Under the Bihar Student Credit Card Scheme (BCCS), the Bihar state government provides students with education loans up to Rs 4 lakh.

Eligibility

- The student should be from Bihar and should have studied 12th in Bihar.

- The annual income of the student's family should be less than INR 6 Lakh.

- The student should be enrolled in an educational institution recognized by the Bihar government.

- The student's age should be between 18 years to 25 years at the time of application.

West Bengal Student

CREDIT CARD SCHEME

Under the West Bengal Student Credit Card Scheme, students in the state can obtain loans up to 10 lakhs without having to provide any collateral.

Eligibility

- This scheme applies only to students whose families have been residents of West Bengal for at least the last ten years at the time of application.

- The student must be 40 years of age or below.

- The student must complete the enrolled course.